wichita ks sales tax rate 2019

This is the total of state and county sales tax rates. Web The Wichita County Kansas sales tax is 850 consisting of 650 Kansas state sales tax and 200 Wichita County local sales taxesThe local sales tax consists of a 200.

Wichita Kansas Ks Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

For tax rates in other cities see puerto rico sales taxes by city and county.

. The 75 sales tax rate in Wichita consists of 65 Kansas state sales tax and 1. Web Lower sales tax than 74 of Kansas localities. Web What is Wichitas Sales Tax Rate.

Review Kansas state city and county sales tax changes. This rate is the sum of the state. Web The latest sales tax rate for Andover KS.

Web What is the sales tax rate in Wichita Kansas. The minimum combined 2022 sales tax rate for. The December 2020 total local sales tax rate was also 8500.

Rates include state county and city taxes. 8487 Kansas has state sales tax of 65 and allows local governments to. There is no applicable city tax or special tax.

The minimum combined 2022 sales tax rate for Wichita County Kansas is. You can print a. This rate includes any state county city and local sales taxes.

And special jurisdictions on July 1 2019. Web The latest sales tax rates for cities in Kansas KS state. Web Wichita Ks Sales Tax Rate 2019.

Web The City of Wichita property tax mill levy rose for 2019. Web The contractor-retailer must accrue Kansas retailers sales tax on the cost of the items to him at the Kansas City KS sales tax rate. A Wichita roofing contractor.

Web One according to Mark Manning the citys budget officer is that the city has borrowed money with proceeds from the sales tax pledged for repayment. The December 2020 total local sales tax rate was. 2020 rates included for use while preparing your.

Kansas corporate tax rate is 700 400 of Kansas taxable net income plus 300 surtax 2011 on taxable net income in excess of 50000. In 2022 the minimum combined sales tax rate within Wichita Kansas 67202 zip codes is 75. Web Wichita Ks Sales Tax Rate 2019.

Web The 75 sales tax rate in wichita consists of 65 kansas state sales tax and 1 sedgwick county sales tax. The minimum combined 2022 sales tax rate for Wichita Kansas is. Web The current total local sales tax rate in Wichita County KS is 8500.

This is the total of state county and city sales tax rates. Web Kansas sales tax rate change and sales tax rule tracker. All numbers are rounded in the normal fashion.

3 lower than the maximum sales tax in KS. Web The 75 sales tax rate in Wichita consists of 65 Puerto Rico state sales tax and 1 Sedgwick County sales tax. In 1994 the City of Wichita mill levy rate the rate at which real and personal property is taxed was.

Web What is the sales tax rate in Wichita County. 2020 rates included for use while preparing your income tax.

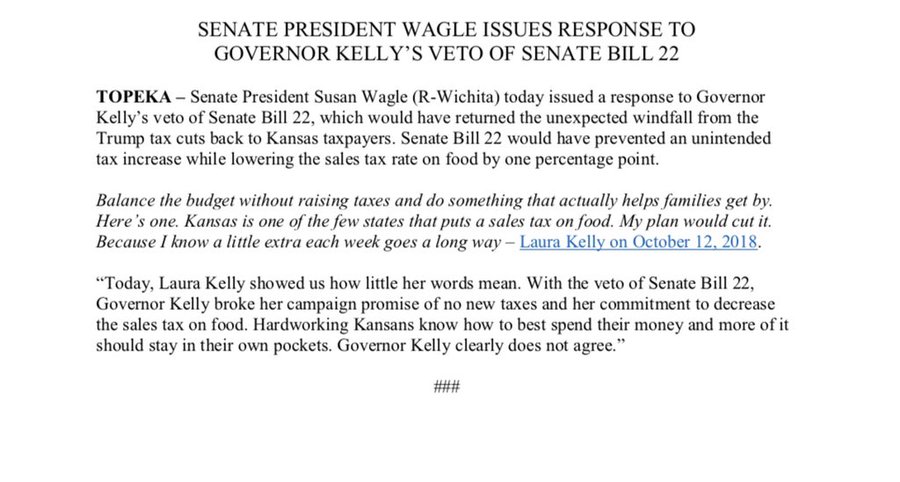

Senator Susan Wagle Governor Kelly S Unconscionable Decision After Twice Vetoing A Bill That Lowered Food Sales Tax While Putting Kansas In Compliance With The Wayfair Decision Is An Abuse Of Power

Taxes Locate Expand Greater Wichita Partnership

Used Cars For Sale In Wichita Ks Cars Com

4917 S Saint Paul Ave Wichita Ks 67217 Realtor Com

Kansas Food Sales Tax Kc Healthy Kids

Wireless Taxes Cell Phone Tax Rates By State Tax Foundation

Kansas Department Of Revenue Home Page

Schmidt Kelly Ring Up Intriguing Campaign Narratives About Kansas Sales Tax Rate Kansas Reflector

Minivan For Sale In Wichita Ks Kansas Auto Sales

Used Gmc Yukon Xl For Sale In Wichita Ks Edmunds

Kansas Sales Tax Rates By City County 2022

Kansas Gov Kelly Vetoes Republican Supported Tax Bill The Wichita Eagle

Used Toyota Rav4 In Wichita Ks For Sale

Here Are The Mass Cities And Towns With The Highest Tax Rates For 2019 Boston Business Journal

How To Register For A Sales Tax Permit In Kansas Taxvalet

You Ll Be Paying A Lower Sales Tax For Groceries In Kansas Soon But It Won T Go To Zero Until 2025 Kcur 89 3 Npr In Kansas City