georgia ad valorem tax motorcycle

Your Georgia drivers license or ID. The line was very long before they opened and it was discouraging at first but once they opened the line moved fast and mary at.

What Do The Column Headings Stand For At The Of These Two Pages Of The Georgia Property Tax Digest 1793 1892 Genealogy Family History Stack Exchange

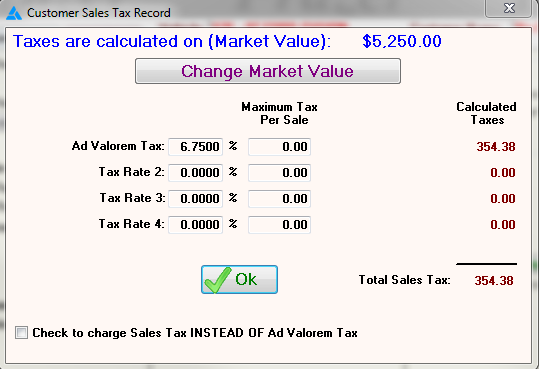

For the Title Ad Valorem Tax TAVT use the 2013 TAVT Assessment Manual.

. 20 Annual License Reg. It replaced sales tax and annual ad valorem tax annual motor vehicle tax and is paid every time vehicle ownership is transferred. NOTE This guide is for the annual ad valorem tax.

Visit the DNC Store. Yes if applicable. TAVT is a one-time fee that replaces the sales tax and the annual ad valorem tax often referred to as the birthday tax on motor vehicles.

Georgia ad valorem tax motorcycle Wednesday March 9 2022 Edit. Jul 26 2012 Messages. Georgia income taxes for the taxable year of death.

5 of TAVT due after day 30 and 5 additional every month thereafter. Title Ad Valorem Tax TAVT became effective on March 1 2013. If you are registering during the registration period for that vehicle you will need to pay the ad valorem tax due at this time.

NOTE This guide is for the annual ad valorem tax. Additionally such taxes shall not apply for any prior taxable year ending on or after the first day served in the combat zone. BD-61 Cable Crossover Machine Features Benefits.

Casual sale Title Ad Valorem Tax penalty for not submitting. 2012 Black Cross Country. 393 Type of Motorcycle Currently Riding.

This includes an annual registration and tag fee of twenty dollars an ad Valorem tax sales tax and a title fee of eighteen dollars. TAVT is a one-time tax that is paid at the time the vehicle is titled. Georgia Department of Revenue gives in depth information on the exact required amount of fee particularly the amount you have to pay as an ad valorem tax which is based on the current market value of your motorcycle.

2014 Vehicle Valuation Manual Registration Ad Valorem Tax iii. Cable machine squat row. Owners of vehicles that fit this category can use the DORs Title Ad Valorem Tax Calculator tool to calculate their.

Only one tag issued. The tax must be paid at the time of sale by Georgia residents or within six months of. 5500 plus applicable ad valorem tax.

2000 annual registration fee. The Annual Ad Valorem Tax is imposed on vehicles that have not been taxed under the Title Ad Valorem Tax in Georgia. You will need to pay the following fees when applying for motorcycle registration and title.

Title Ad Valorem Tax TAVT The current TAVT rate is 66 of the fair market value of the vehicle. The Commissioner of the Georgia Department of Revenue is charged by law with the annual. The Annual Ad Valorem Tax is determined on an annual basis and is required to.

Ad Valorem Tax on Vehicles This exemption applies to either the annual property tax or. Georgia Ad Valorem tax Discussion in Victory General Discussion started by Bobbyd85 Jan 14 2015. For the Title Ad Valorem Tax TAVT use the 2015 TAVT Assessment Manual.

Vehicles purchased on or after March 1 2013 and titled in Georgia are subject to Title Ad Valorem Tax TAVT and are exempt from sales and use tax and the annual ad valorem tax. 20 annual registrationtag fee. Submit the above either in person or by mail to your local county tag office.

Legislation enacted by the Georgia General Assembly in 2012 created a new system for taxing motor vehicles. Ad Valorem Taxes If applicable no exemptions on additional tags. 10 of Ad Valorem Tax due 25 of License Plate Fees.

Payment for the 20 registration fee plus any other applicable taxes and fees. This tax is based on the value of the vehicle. Ad Valorem Tax Required.

2500 one time fee Annual Registration Fee. Motor vehicle dealers should collect the state and local title ad valorem tax fee TAVT from customers purchasing vehicles on or after March 1 2013 that will be titled in Georgia. Jan 14 2015 1.

As of 2018 residents in most Georgia counties pay a one-time 7 percent ad valorem tax on these vehicles at the time of purchase. Registration Fees Taxes. 2015 Vehicle Valuation Manual Registration Ad Valorem Tax DO NOT USE for TAVT iii.

Contact your local County Tag Office for details. Ad Valorem Taxes If applicable Cost to renew additional plate. Ad valorem Penalty has a 500 minimum.

Annual Special Tag Fee. Anybody registered a 2012 or 2013 victory in Georgia brought in from another. Being changed to a state and local title ad valorem tax or TAVT.

Machine row squat wallpaper. Cost of additional plate. Title Ad Valorem Tax TAVT The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative session.

Georgia requires minimum-liability insurance on all motor vehicles. Fee 1 to the County Tag Agent 59 to State of Georgia General Treasury Annual Renewal. As a result the annual vehicle ad valorem tax sometimes called the birthday tax is.

Proof of Georgia motorcycle insurance. Valid drivers license or picture ID. Title Ad Valorem Tax Estimator calculator Get the estimated TAVT tax based on the value of the.

Dealer Title Ad Valorem Tax penalty for not submitting TAVT within 30 days of purchase. Motorcycles may be subject to the following fees for registration and renewals. US Army Ranger Motorcycle.

2500 manufacturing fee one-time fee 2000 annual registration fee. Cost to renew annually. MV-9W Please refer to this form for detailed instructions and requirements.

100 dolorosa san antonio tx 78205 phone. We would like to show you a description here but the site wont allow us. Only one additional plate issued.

In 2013 Georgia created the Title Ad Valorem Tax or GA TAVT for vehicles purchased in March 2013 and later. The Commissioner of the Georgia Department of Revenue is charged by law with the annual. According to Chapter 22 of Publication 17 the IRS allows you to deduct the ad valorem tax vehicle value off your income taxes.

Property Tax Map Tax Foundation Tuesday February 22 2022 Edit. Georgia ad valorem tax motorcycle. 80 plus applicable ad valorem tax.

New Plate Demo Page. 2022 data current as of dec 6 2021 122am. Get the estimated TAVT tax based on the value of the vehicle using.

Payment of the TAVT provides an exemption from sales tax on the motor vehicle and the purchaser will also be exempt from the annual ad valorem tax or. 18 title fee and 10 fees for late registration. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state.

Of the Initial 80 fees collected for the issuance of these tags the fees shall be distributed as follows. Ad valorem tax which varies depending on your motorcycles purchase price. Bexar county tax assessor and collector.

Georgia Motor Vehicle Ad Valorem Assessment Manual

What Do The Column Headings Stand For At The Of These Two Pages Of The Georgia Property Tax Digest 1793 1892 Genealogy Family History Stack Exchange

James E Hardwick Discovered In Georgia Property Tax Digests 1793 1892 Property Tax Hardwick Georgia

History Engine 3 0 Vulnerability History The Past

Georgia Department Of Revenue A Motor Vehicle Division Title Ad

Georgia Registration Ad Valorem Tax R Carvana

What Are Ad Valorem Taxes Henry County Tax Collector Ga

47605 Yale Road Chilliwack Bc V2p 7m8 First Time Home Buyers Bright Living Room Beautiful Homes

Frazer Software For The Used Car Dealer State Specific Information Georgia

Georgia Department Of Revenue A Motor Vehicle Division Title Ad

We Are Prominent Tax Firm Operating In Both Atlanta And Georgia We Have Highly Skilled And Profess Bookkeeping Services Small Business Consulting Tax Services

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

Laziness Could Lead To Smaller Brain Size Car Insurance Claim Car Insurance Farmers Insurance

What Is The Sales Tax Rate In Richmond County Ga Cubetoronto Com

James Hardwick Discovered In Oregon Motor Vehicle Registrations 1911 1946 Motor Car Vehicles Motor